Biden’s Temporary Buydown

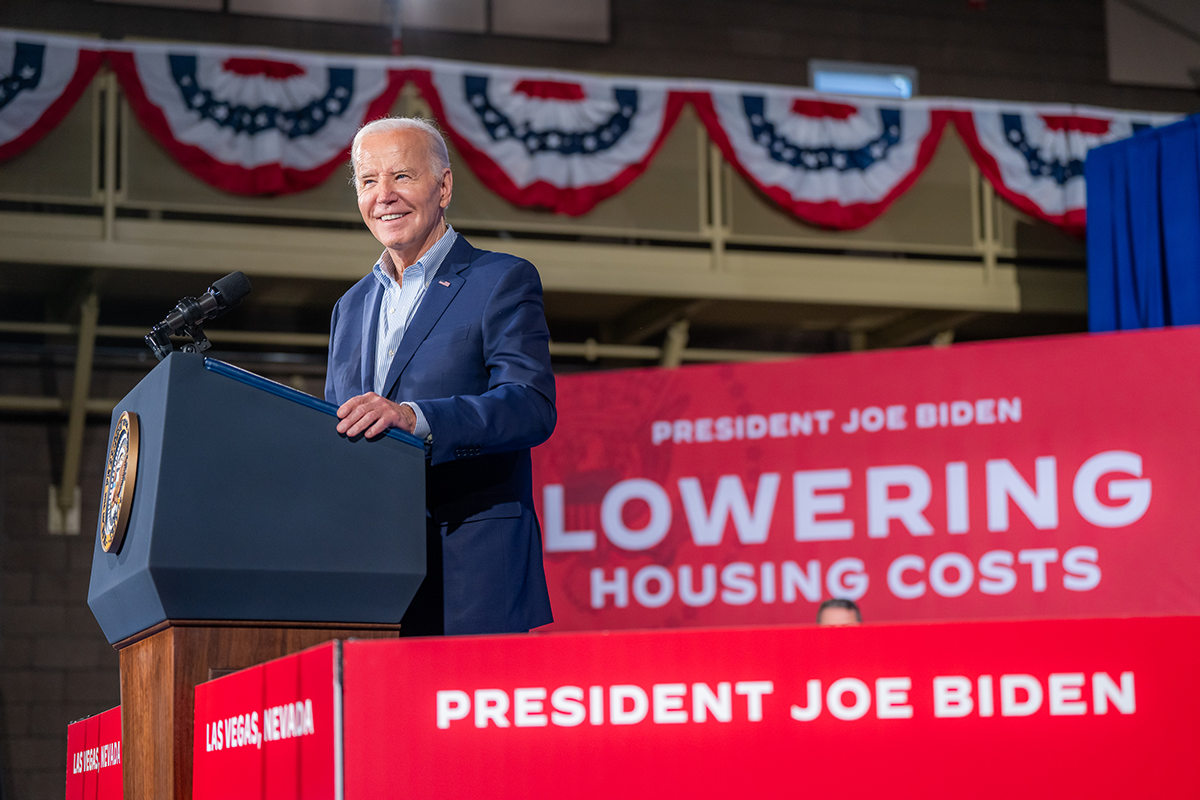

President Joe Biden has announced a new initiative aimed at easing the path to homeownership for middle-class Americans. In a tweet on Friday, Biden highlighted his administration’s plan to provide substantial financial relief to first-time homebuyers.

- “My dad always used to say that the way you build wealth is by building equity in your home. My housing plan would help Americans achieve homeownership by giving households $400 a month for two years when they buy their first home,”

Driving the News: The White House’s proposed housing plan introduces a mortgage relief credit, offering first-time homebuyers an annual tax credit of $5,000 for two years. This initiative equates to a reduction in mortgage rates by more than 1.5 percentage points for two years on a median-priced home. The plan is projected to assist over 3.5 million middle-class families in purchasing their first homes over the next two years.

The Problem: Mortgage temporary buydowns, which reduce interest rates for a limited period, do not significantly enhance housing affordability today because borrowers must qualify at the full loan rate, not the initial lower teaser rate, unlike the period before the Great Financial Crisis. While the proposed $5,000 annual tax credit might alleviate some financial pressure for those already qualified to buy, it fails to enable additional prospective buyers to qualify for mortgages, as it does not alter the financial requirements tied to the full interest rate.

The Big Picture: Biden’s administration has faced criticism for focusing solely on demand-side subsidies amid a housing market plagued by rising prices due to supply shortages. Critics argue that boosting demand without addressing supply constraints will only make home prices go up.

Demand Side: To tackle the inventory issue, Biden has proposed a one-year tax credit of up to $10,000 for middle-class families who sell their starter homes—defined as homes priced below the area median home price—to other owner-occupants. This measure is expected to assist nearly 3 million families and aims to increase the availability of starter homes.

- President is also calling on Congress to pass legislation to build and renovate more than 2 million homes, which would close the housing supply gap and lower housing costs for renters and homeowners.

What They’re Saying: While the plan to provide tax credits for selling starter homes may help increase the inventory of affordable homes, it does not fully address the broader issue of overall housing supply. Industry experts stress that more comprehensive measures are needed to tackle the persistent shortage of homes on the market.

What’s Next: The success of Biden’s housing plan will depend on congressional approval and the implementation of complementary policies to increase housing supply. The administration continues to push for legislative support to enact these tax credits and address the multifaceted challenges facing the U.S. housing market.

Housing Impact: Like the drop in rates in 2020, housing affordability will improve for some as the program launches as wannabe homeowners will have an extra $400 to spend on housing. However, like in 2020, home prices adjusted to the increased purchasing power of buyers which is likely to happen again unless something is done about the ongoing inventory shortage.