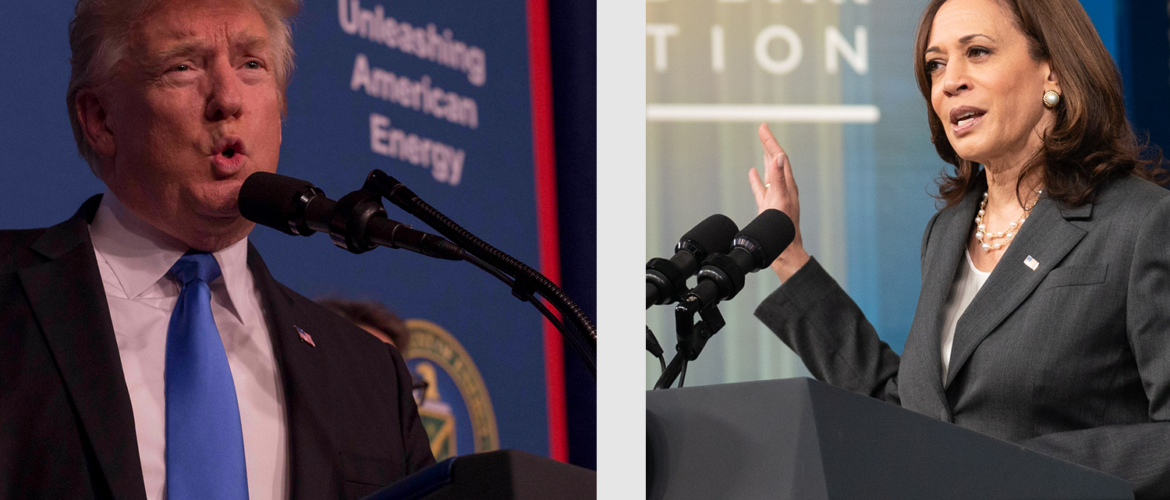

A new analysis by the Committee for a Responsible Federal Budget (CRFB) has raised a red flag on the fiscal plans of both former President Donald Trump and Vice President Kamala Harris, projecting that each candidate’s proposals will add significantly to the national debt if elected.

- According to CRFB, Trump’s proposals would increase the debt by $7.75 trillion, while Harris’s plans would add $3.95 trillion through 2035.

Why It Matters: The U.S. national debt has already reached historically high levels, posing a serious risk to economic stability and policy flexibility. If left unchecked, this growing debt could lead to higher interest rates, reduced national security, restricted government spending options, and an elevated chance of a fiscal crisis.

Break It Down: Trump’s continuation of tax cuts, initially enacted during his administration, stands as one of the largest revenue-reducing elements in his plan. By extending these tax cuts without corresponding reductions in spending, the CRFB estimates a revenue shortfall of $5.3 trillion over the next decade.

- Trump proposes exempting certain income sources—overtime income, Social Security benefits, and tip income—from taxation. These exemptions would further increase the deficit by $3.6 trillion.

- Even with expected tariff revenue of $2.7 trillion, Trump’s plan is estimated to fall short by $6.1 trillion, leaving a substantial gap that would contribute heavily to the national debt.

Harris’s fiscal approach involves continuing Trump-era tax cuts for individuals earning below $400,000, costing an estimated $3 trillion over ten years. Key initiatives under Harris’s proposal include expanding the Child Tax Credit and the Earned Income Tax Credit ($1.4 trillion), Affordable Care Act (ACA) subsidies ($550 billion), and investments in affordable housing ($250 billion). Together, these spending initiatives would add approximately $5 trillion to the deficit.

- Harris seeks to counterbalance this with targeted tax increases: a higher corporate tax rate ($900 billion), increased capital gains taxes ($850 billion), and a boost in Medicare taxes ($800 billion). Yet, these revenue increases still leave a $2.5 trillion gap over the forecast period.

The Big Picture: Both Trump and Harris face a similar fiscal obstacle: a lack of substantial offsets to mitigate the revenue losses from their spending and tax proposals. Trump’s deficit stems largely from aggressive tax cuts without corresponding spending reductions, while Harris’s shortfall arises from increased spending initiatives with insufficient new revenue to cover the costs.

What’s Next: The CRFB’s report underscores the need for future administrations to prioritize sustainable fiscal policies that address, rather than exacerbate, the nation’s growing debt burden. Without substantial action to curb the debt, economic growth could stall, interest payments on the debt could soar, and critical government programs could face insolvency.

Bottom Line: In the face of record-breaking debt levels, neither candidate has put forth a viable path toward reducing the deficit. The next administration will inherit not only a substantial fiscal challenge but also a pressing need to prioritize debt reduction as a cornerstone of economic policy.