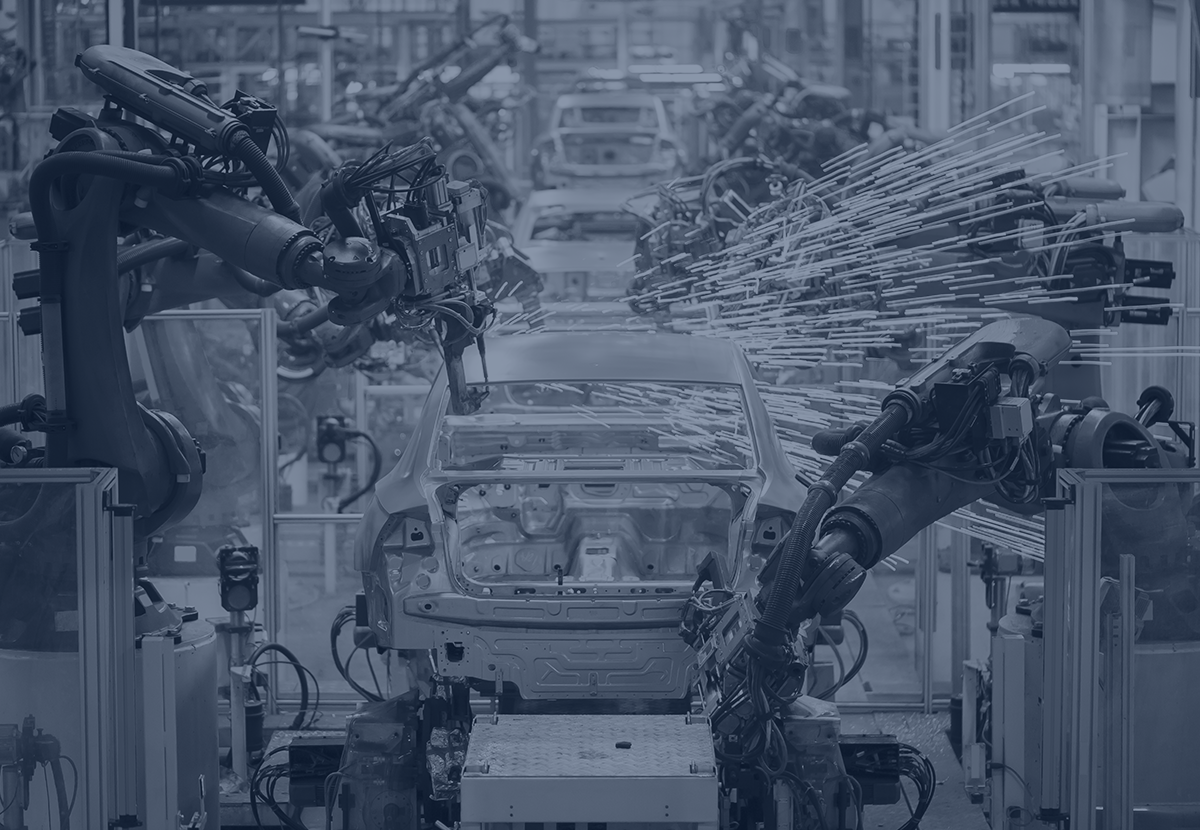

Economic activity in the U.S. manufacturing sector fell for the fourth consecutive month in May, underscoring continued struggles driven by tariffs and softening demand, according to the latest Manufacturing ISM Report on Business.

- The Manufacturing PMI fell slightly to 48.5% in May—down from 48.7% in April—marking the lowest reading since November 2024 and missing economists’ expectation of a rise to 49%.

By The Numbers: New orders remained in contraction territory for the fourth month in a row but improved marginally to 47.6%, the strongest showing since February.

- Employment also ticked up slightly to 46.8%, staying in contraction but posting the best reading since February, signaling cautious optimism about labor conditions.

- Meanwhile, inflation pressures remain elevated, with the Prices Index at 69.4%, down slightly from April but still close to a three-year high.

What they’re saying: A respondent from miscellaneous manufacturing highlighted ongoing tariff uncertainty, saying, “Tariff whiplash continues. While the easing of tariff rates between the U.S. and China in May was welcome news, the question is what happens in 90 days.” The respondent added that creating contingency plans is “hugely distracting from strategic work.”

Bottom Line: Manufacturing continues to face challenges, with tariff uncertainty and cost pressures dampening broader economic recovery despite some modest improvement beneath the headline numbers